WASHINGTON (AP) — As he campaigned for the presidency, Joe Biden promised to spend billions of dollars to “save the world” from climate change. One of the largest players in the solar industry was ready.

Executives, officials and major investors in First Solar, the largest domestic maker of solar panels, donated at least $2 million to Democrats in 2020, including $1.5 million to Biden’s successful bid for the White House. After he won, the company spent $2.8 million more lobbying his administration and Congress, records show — an effort that included high-level meetings with top administration officials.

The strategy was a dramatic departure from the Arizona-based company’s posture under then-President Donald Trump, whom corporate officials publicly called out as hostile toward renewable energy. It has also paid massive dividends as First Solar became perhaps the biggest beneficiary of an estimated $1 trillion in environmental spending enacted under the Inflation Reduction Act, a major piece of legislation Biden signed into law in 2022 after it cleared Congress solely with Democratic votes.

Since then, First Solar’s stock price has doubled and its profits have soared thanks to new federal subsidies that could be worth as much as $10 billion over a decade. The success has also delivered a massive windfall to a small group of Democratic donors who invested heavily in the company.

Ahead of what is shaping up to be a tight race for the White House this year, Biden and his fellow Democrats point to the sprawling legislation as an example of investing in alternative energy in ways that will help the environment and lift the economy. But First Solar offers an example of how the same piece of legislation, shaped by a team of lobbyists and potentially influenced by a flood of campaign cash, can yield mammoth returns for the well-connected.

First Solar’s top lobbyist, Samantha Sloan, offered a revealing glimpse of the company’s reach after a bill signing celebration.

“Those of us who’ve worked on this know that none of this would have been possible without the dedication and collaboration of a group of Congressional staffers who worked long hours” to ensure that the law would “deliver as intended,” she posted on LinkedIn alongside a photo of herself beaming on the White House South Lawn.

Angelo Fernández Hernández, a White House spokesperson, did not directly address First Solar’s efforts to curry favor with the Biden administration.

“President Biden has led and delivered on the most ambitious climate agenda in history, restoring America’s climate leadership at home and abroad,” Fernández Hernández said in a statement. “The White House regularly engages with industry leaders across all sectors, including clean energy manufacturers and gas and oil producers.”

In a statement, First Solar CEO Mark Widmar said the new subsidies have helped build the company’s domestic footprint. He also took a swipe at some of First Solar’s rivals with ties to China, which dominates the industry.

“Unlike others who routinely spend substantially more lobbying on behalf of Chinese companies that circumvent US laws and deepen strategic vulnerabilities, our interests lie in a diverse, competitive domestic solar manufacturing base supporting American jobs, economic value, and energy security,” Widmar said.

Founded in 1999 by a private equity group that included a Walmart fortune heir, First Solar went public in 2006, the same year former Vice President Al Gore’s movie “An Inconvenient Truth” helped raise consciousness about the threat of climate change. Company officials cultivated a constituency with Democrats during Barack Obama’s administration, which in turn subsidized their industry — and First Solar — through billions of dollars in government-backed loans.

When the Biden administration started writing rules to implement the Democrats’ new law, First Solar executives and lobbyists met at least four times in late 2022 and 2023 with administration officials, including John Podesta, who oversaw the measure’s environmental provisions. One of the more intimate gatherings was attended by Podesta, Widmar and Sloan, as well as First Solar’s contract lobbyist, Claudia James, an old friend of Podesta’s who worked for decades at a lobbying firm run by Podesta’s brother, Tony, records show.

Widmar and Sloan also attended a September 2022 celebration at the White House, according to records and social media posts, with Sloan praising the new law as “one of the most consequential pieces of legislation of our lifetimes.”

The law has been consequential for First Solar.

The company will benefit from billions of dollars in lucrative tax credits for domestic clean energy manufacturers — a policy aimed at putting the U.S. on a more competitive footing with green energy giant China. Though intended to reward clean energy businesses, the credits can also be sold on the open market to companies that have little to do with fighting climate change.

Last December, First Solar agreed to sell roughly $650 million of these credits to a tech company — providing a massive influx of cash, courtesy of the U.S. government.

Investors in the company, including a handful of major Democratic donors, have also benefited as First Solar’s share price soars.

Farhad “Fred” Ebrahimi, co-founder of the software company Quark, was added to Forbes billionaires list in 2023 thanks to the skyrocketing value of his roughly 5% stake in First Solar, financial disclosures show. Ebrahimi, along with his wife and family, contributed at least $1 million to Biden’s 2020 election effort, according to campaign finance disclosures.

Lukas T. Walton, an heir to the Walmart fortune, held a 4.9% interest in the company, according to financial disclosures from 2020. Walton donated $360,000 to Biden’s 2020 campaign, as well as $100,000 to his 2021 inauguration, campaign finance records show.

For a period, there were real doubts about whether Democrats could reach a consensus and approve the bill, which had stalled in the Senate in late 2021. A breakthrough came the following July when Senate Majority Leader Chuck Schumer of New York and holdout Sen. Joe Manchin of West Virginia began secret negotiations in hopes of reviving it.

A day after the two lawmakers began meeting, Democratic megadonor Jim Simons, an enthusiastic backer of the party’s green energy efforts, gave $2.5 million to Schumer’s super PAC, which spends tens of millions of dollars each election season supporting Senate Democrats.

Renaissance Technologies, a hedge fund founded by Simons, also started buying First Solar shares. The hedge fund purchased 60,000 shares between July, when Schumer was privately negotiating with Manchin, and September, when Biden held a celebration after signing the bill, financial filings show. The fund eventually increased its position to 1.5 million shares, which it sold in 2023 after the company’s stock price price shot up.

Simons, who died in May, was no ordinary donor. His family contributed $25 million to Democrats in 2022, records show. And in the past, he had said that he helped Schumer craft legislation and called the New York Democrat as “a pretty good friend of mine,” according to a 2020 oral history interview with the American Institute of Physics.

A spokesperson for Schumer said the Senate leader did not speak with Simons about the negotiations.

“At Sen. Manchin’s request no one outside of Sen. Schumer’s staff or Sen. Manchin’s staff was told about the negotiations,” the spokesperson said. A Manchin spokesperson did not respond to a request for comment.

A representative for Renaissance Strategies said the hedge fund uses computer-based trading strategies that “do not involve human stock-picking.”

Democrats’ investments in alternative energy companies have not always panned out. The 2011 bankruptcy of Solyndra, which had received a $500 million government-backed loan, became a rallying cry for Republicans.

It also drew a spotlight to First Solar, whose chairman was called to testify before the GOP-controlled House Oversight Committee in 2012, when he was grilled about strong-arm tactics used to secure over $2 billion in loans from the Obama administration for projects First Solar was involved with.

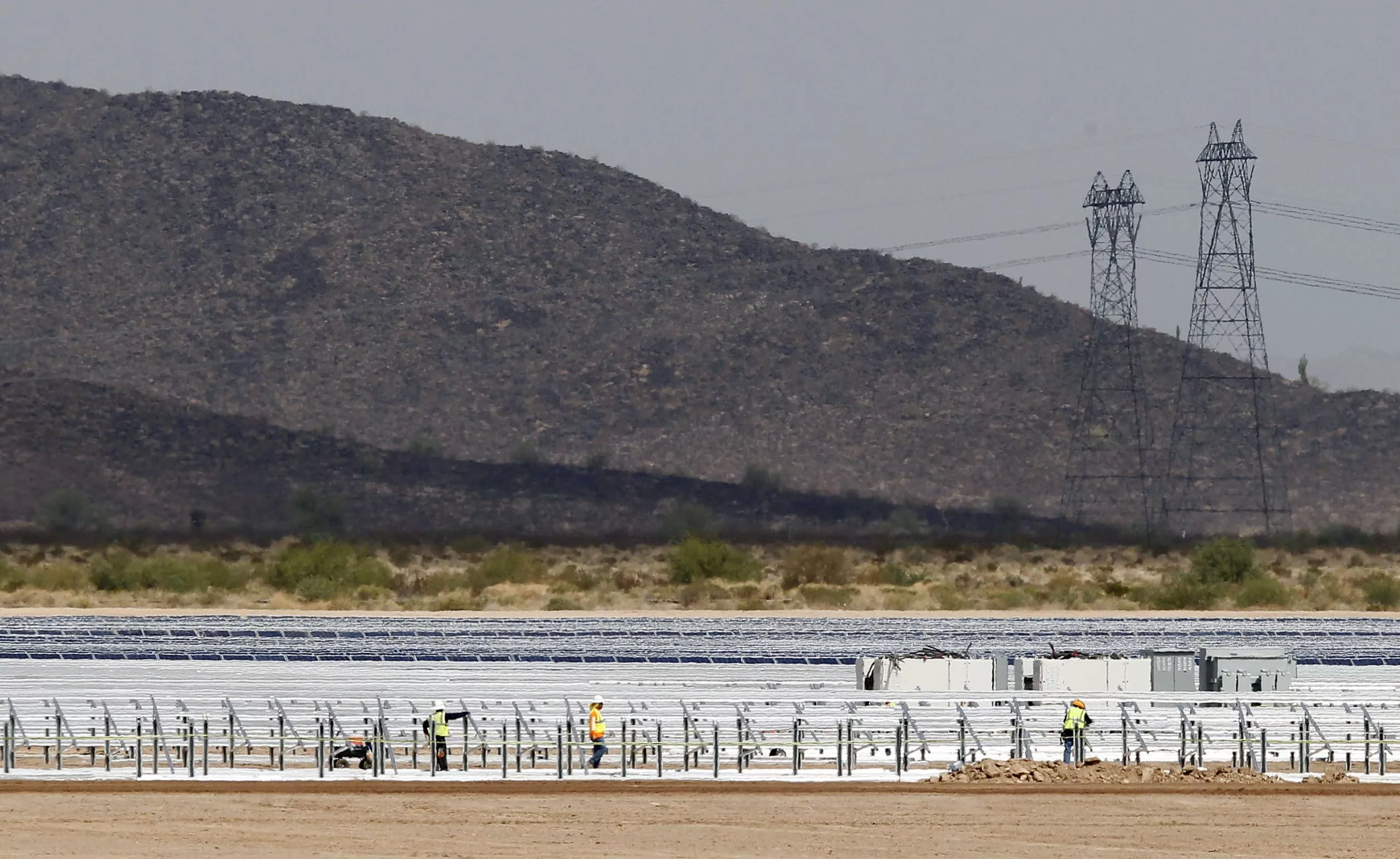

In an email turned over to House Republicans, a First Solar executive pressured the Department of Energy for the financing, suggesting that otherwise a Mesa, Arizona, factory that Obama administration officials were eager to tout may not be built.

“A failure to receive” approval could “jeopardize construction” and “frankly, undermine the rationale for a new manufacturing center in Arizona,” the former executive wrote in 2011.

The loans were granted. The factory, however, was never completed.

First Solar spokesman Reuven Proenca said the decision was driven by a solar industry downturn and the company also shuttered a factory in Germany.

More recently, the company paid $350 million to settle a securities fraud lawsuit — an agreement announced shortly before the case was set to go to trial. The company denied wrongdoing and the settlement in 2020 included no admission of liability.

Details included in the case file offer a damning portrait. Investors accused company officials of lying about the scope of a defect that caused panels to fail prematurely, court records state. It was a decision, investors argued, driven by company executives’ desire to preserve First Solar’s stock price.

But while First Solar officials downplayed the extent of the problem, some of them dumped personally held stock, according to court records. Mark Ahearn, the company’s founder and chairman, alone sold off more than $427 million in shares before the extent of the defect was made public and the stock tumbled. The ordeal ultimately cost the company $260 million to fix, court records state.

Proenca, the First Solar spokesman, said the company settled the case to “focus on driving the business forward.”

Because First Solar is the biggest U.S.-based solar manufacturer, green energy advocates say Biden faces no other choice than subsidizing the company if he wants to meet his ambitious climate goals while becoming more competitive with China.

“Hopefully they’ve reformed,” said Pat Parenteau, an emeritus professor at Vermont Law School and a senior fellow at the Environmental Law Center. “They may be an imperfect vehicle. But the reality is we desperately need them.”

Brought to you by www.srnnews.com