WASHINGTON (AP) — U.S. consumers cut back sharply on spending last month, the most since February 2021, even as inflation declined, though stiff tariffs threatened by the White House could disrupt that progress.

Americans cut their spending by 0.2% in January from the previous month, the Commerce Department said Friday, likely in part because of unseasonably cold weather. Yet the retreat may be hinting at more caution by consumers amid rising economic uncertainty.

Inflation declined to 2.5% in January compared with a year earlier, down from 2.6% in December, the government said. Excluding the volatile food and energy categories, core prices dropped to 2.6%, the lowest since June, from 2.9%.

One other bright spot in the report was that incomes jumped 0.9% in January from December, fueled in part by a large annual cost of living adjustment for Social Security beneficiaries.

Inflation spiked in 2022 to its highest level in four decades, propelling President Donald Trump to the White House and causing the Federal Reserve to rapidly raise interest rates to tame prices. It has since fallen from a peak of 7.2%.

Last month’s decline could reassure Fed officials that inflation is still slowly cooling. The Fed prefers Friday’s measure to the more widely-known consumer price index, which rose for the fourth straight month in January to 3%. Friday’s gauge calculates inflation slightly differently: For example, it puts less weight on the costs of housing and used cars.

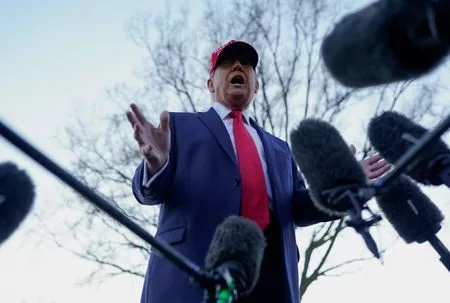

Even so, the key question preoccupying many American consumers, investors, and business executives is whether Trump’s extensive tariff proposals will push prices higher in the coming months. Trump said Thursday he will double his recently-announced tariffs on Chinese imports to 20%, and will impose 25% import taxes on Canada and Mexico next Tuesday. The three countries are the United States’ top trading partners.

Trump is also calling for widespread layoffs of federal workers, which could cause hundreds of thousands of job losses and potentially lift the unemployment rate.

“Increased uncertainty surrounding trade, fiscal and regulatory policy is casting a shadow over the outlook,” said Lydia Boussour, a senior economist at accounting and consulting firm EY.

Americans also likely cut back on their spending after a healthy winter holiday season that saw a surge in credit card debt in December, economists noted.

On a monthly basis, prices rose 0.3% in January from the previous month, matching December’s 0.3% increase. Core prices rose 0.3%, up from 0.2% in December. If sustained, January’s increases would keep inflation running above the Fed’s target. The Fed pays more attention to core prices because they provide a better read of future inflation.

A big concern right now is whether tariffs will push up inflation, or slow the economy, or — in a particularly toxic combination — both.

A report from the Federal Reserve’s Boston branch this month concluded that 25% tariffs on Canada and Mexico, along with Trump’s initial 10% import taxes on China, could lift core inflation by as much as 0.8 percentage points.

The last time Trump imposed tariffs in 2018-19, inflation was largely unaffected — but those tariffs were on a much narrower range of goods. And the economy still slowed, prompting the Fed to cut interest rates.

Worries about tariffs pushing prices higher have sent consumer confidence plunging, unwinding the modest gains that had occurred after the election. Americans are also expecting inflation to move higher in the coming months. That’s a risky trend because if consumers and businesses expect higher prices, they may act in ways to lift inflation, such as accelerating their purchases and boosting demand.

Brought to you by www.srnnews.com